Table of Contents

The artificial intelligence (AI) space is purple-incredibly hot appropriate now. Providers throughout each market are looking to capitalize on the technological innovation, and are investing intensely to gain an edge about the competitiveness. That’s real in the social media space, exactly where advertisers are eager to get in front of the right viewers for them.

While the social media landscape is jam-packed with levels of competition, one organization is separating by itself from the pack. Meta Platforms (NASDAQ: META) is earning strides across different features of the AI realm, and its functionality above the competitors shows.

Let us dig in to why now is a worthwhile chance to devote in Meta as the lengthy-time period AI narrative performs out.

The earnings device is up and operating

A person of the most interesting elements of Meta is how proficiently administration operates the organization. In 2023, Meta grew income 16% yr around yr to $135 billion. Having said that, the enterprise increased money from functions by a whopping 62% yr around 12 months to $46.7 billion.

By expanding its functioning margin, Meta recognized important progress on the bottom line as perfectly. Final 12 months, the company generated $43 billion in free of charge funds move. With this sort of a strong money profile, Meta is properly-positioned to make investments revenue back into the small business as well as reward shareholders.

Investing for the upcoming

Throughout Meta’s fourth-quarter earnings phone in February, traders discovered how the corporation is deploying its hard cash heap. For starters, it has greater its share repurchase software by $50 billion. This is encouraging to see as it could imply that management views Meta inventory as a excellent price.

But most likely a lot more fascinating was the announcement of a quarterly dividend. Several higher-growth tech organizations are not in a fiscal place to pay a dividend — or instead pick out to reinvest earnings into investigate and enhancement or internet marketing strategies. Meta’s new dividend unquestionably sets the enterprise apart from several of its peers, and is a nice sweetener for very long-time period shareholders.

A different way Meta is employing its income flow is in the realm of artificial intelligence. Like many enterprises, Meta depends greatly on advanced graphics processing units (GPUs) from Nvidia. On the other hand, Meta has been hinting for a when that the corporation is investing in its possess components. Before this thirty day period, Meta introduced that an current version of its teaching and inference chips, termed MTIA, is now readily available.

This is significant for a pair of factors. Specifically, in-property chips will enable Meta to “control the complete stack” and scale back its reliance on semiconductors from third functions. Furthermore, provided the company’s awareness foundation of data that it collects from social media platforms Facebook, Instagram, and WhatsApp, these new chips place Meta in a position to increase its focused advice styles and ad campaigns through the power of generative AI.

A powerful valuation

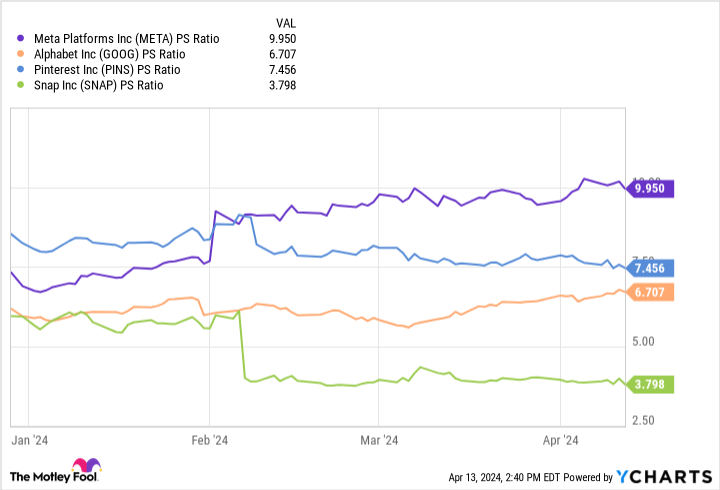

Meta competes with a selection of gamers in the social media landscape. Alphabet is a single of the firm’s top rated rivals given that it operates the world’s top rated-two most frequented sites: YouTube and Google. On the other hand, in 2023 Alphabet only grew its main advertising organization by 6% yr about yr. By contrast, Meta’s advertising and marketing section greater 16%.

Though Meta’s value-to-profits (P/S) ratio of 10 is increased than lots of of its social media friends, the company’s progress in the remarkably competitive and cyclical marketing landscape may possibly warrant the top quality.

Moreover, looking at Meta’s rate-to-cost-free-funds-movement ratio of about 31 is truly trading reasonably in line with its 10-year regular of 32, the stock may well not be as highly-priced as it appears.

In general, I am optimistic about Meta’s intense ambitions in synthetic intelligence — an financial commitment that is nevertheless to enjoy out. The AI narrative is likely to be a prolonged-time period tale. But I see Meta as particularly properly-outfitted to take gain of secular themes fueling AI, and benefiting throughout its entire organization.

The mix of a dividend, share buybacks, regular income movement, and a persuasive AI enjoy make Meta adhere out in a really contested AI landscape. I think now is a fantastic possibility to scoop up shares in Meta and get ready to hold for the long time period.

Ought to you commit $1,000 in Meta Platforms suitable now?

In advance of you invest in inventory in Meta Platforms, think about this:

The Motley Idiot Inventory Advisor analyst workforce just determined what they consider are the 10 greatest shares for traders to obtain now… and Meta Platforms wasn’t a person of them. The 10 stocks that made the slash could deliver monster returns in the coming yrs.

Think about when Nvidia built this listing on April 15, 2005… if you invested $1,000 at the time of our suggestion, you’d have $540,321!*

Stock Advisor presents buyers with an quick-to-comply with blueprint for success, such as advice on constructing a portfolio, common updates from analysts, and two new stock picks each month. The Inventory Advisor services has extra than quadrupled the return of S&P 500 considering that 2002*.

*Stock Advisor returns as of April 15, 2024

Suzanne Frey, an government at Alphabet, is a member of The Motley Fool’s board of administrators. Randi Zuckerberg, a former director of market place growth and spokeswoman for Fb and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of administrators. Adam Spatacco has positions in Alphabet, Meta Platforms, and Nvidia. The Motley Idiot has positions in and suggests Alphabet, Meta Platforms, Nvidia, and Pinterest. The Motley Fool has a disclosure policy.

A As soon as-in-a-Era Expense Option: 1 Scorching Synthetic Intelligence (AI) Inventory to Acquire Hand Around Fist in April was at first printed by The Motley Idiot